PSD2: Strong customer authentication, explained

On September 14th, 2019, requirements for authenticating online payments went into effect in Europe as part of the second Payment Services Directive (PSD2). One of the new requirements of PSD2 is known as Strong Customer Authentication.

What is Strong Customer Authentication?

PSD2 is an EU directive that is was implemented to revise the payments process in the EU. This revision includes stronger protections for consumers when making payments online by regulating payment services and payment service producers in the EU. An important element of PSD2 is the requirement for Strong Customer Authentication (SCA).

The SCA requires that online payment processors build additional authentication into their checkout flow. SCA requires authentication to use two of the following three elements. Something the customer:

-

Knows (e.g. password or PIN)

-

Has (e.g. phone or hardware token)

-

Is (e.g. fingerprint or face recognition)

If an SCA-required payment does not meet these criteria, it may be declined by the bank.

When is Strong Customer Authentication required?

SCA applies to “customer-initiated” online payments if both the business and the cardholder’s bank are located in the European Economic Area (EEA). The original SCA requirements were updated to protect customers further. As a result, financial services institutions (including your bank or credit card company) and payment services providers (e.g. Stripe or PayPal) will be revising their processes so that many types of card payments will now require SCA.

Since this applies to “customer-initiated” online payments, recurring payments or subscription payments may not require strong authentication as they are considered “merchant-initiated”.

What has Teachable done to help you prep?

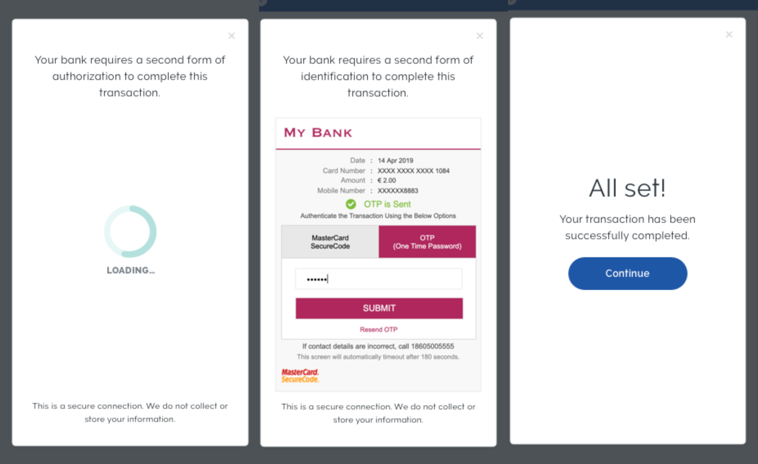

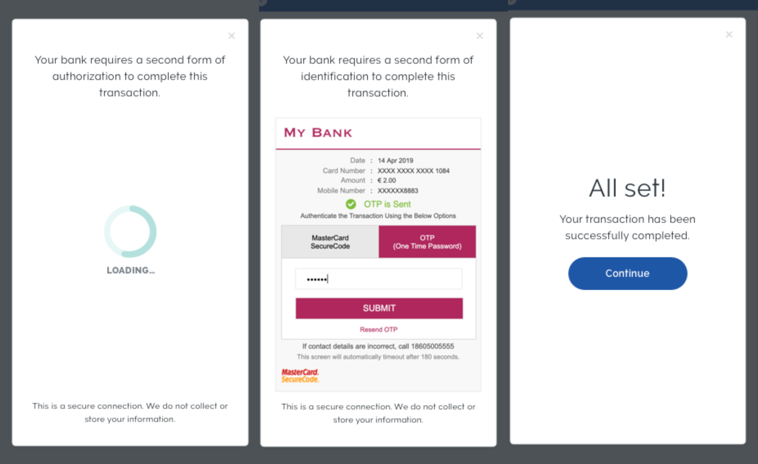

Teachable partners with Stripe for credit card processing. Stripe has prepared for PSD2 and SCA and built new technology to help minimize any friction in the payments experience. Using Stripe’s new software, we’ve added an additional step to the checkout flow when SCA is required. Similarly, PayPal has also already implemented its own SCA checkout flow.

Your sales page showcases what you have to offer. Follow our step-by-step checklist to make sure it does.

This additional authentication is automatically available for all Teachable schools. There is no action required from any school owner to take advantage of these new SCA checkout flow.